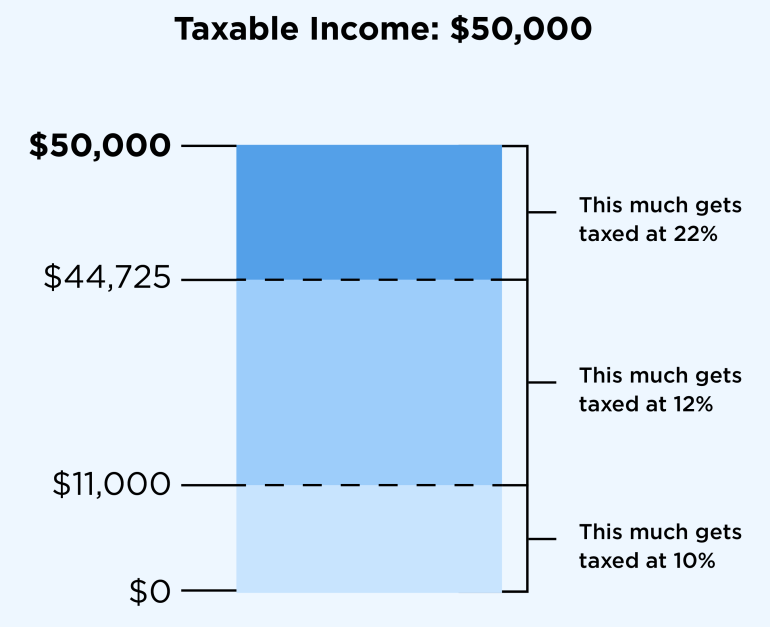

2024 Tax Brackets Calculator Married Jointly – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . and this amount fluctuates depending on whether you are married couples filing separately and jointly. Figuring out your tax obligation isn’t as easy as comparing your salary to the brackets .

2024 Tax Brackets Calculator Married Jointly

Source : www.forbes.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

2024 Tax Brackets Calculator Married Jointly Your First Look At 2024 Tax Rates: Projected Brackets, Standard : When tax return season rolls around, married couples have to decide whether to file their taxes jointly or separately. Filing jointly is far more common and usually results in a lower tax bill. . Married taxpayers have the choice to file jointly or separately may find themselves in a lower tax bracket than if they had filed separately. Calculate your gross income by adding up earnings. .